Build Playful Money Wisdom at Home

Today we dive into creating DIY budgeting board games that help families talk about money with ease. Using cardboard, markers, and imagination, you’ll design playful challenges about earning, spending, saving, and giving, turning tricky conversations into laughter and teamwork. Expect simple blueprints, clever mechanics, and stories that stick, so every age learns practical skills together. We’ll also share tips for testing, adapting, and connecting gameplay to real allowances, chores, and shopping decisions. Subscribe for fresh printable packs, and share your house rules and table photos so our community can celebrate your clever ideas and learn alongside your family.

Start Crafting: From Cardboard to Conversation

Begin with what you already have at home and a clear goal: spark honest money chat while having fun. We’ll outline materials, safe cutting tips, and layout basics that make boards readable, durable, and exciting. By building together, you normalize questions about price, trade-offs, and planning without lectures.

Household Materials Checklist

Raid the recycling bin for sturdy corrugated cardboard, cereal boxes for cards, jar lids for tokens, and rubber bands for banks. Add markers, glue, and tape. These humble supplies keep costs low, invite creativity, and show kids that resourcefulness beats fancy purchases every time.

Board Layout That Teaches

Arrange spaces to reflect a monthly money journey: paydays, bills, unexpected events, savings goals, and charitable choices. Big icons help pre-readers, while color-coded paths cue decisions. Clear iconography reduces rule confusion and frees attention for discussion, strategy, and the feelings money choices bring.

Safety and Durability Tricks

Round sharp corners, reinforce folds with fabric tape, and seal high-traffic areas using clear packing tape. Laminate cards with contact paper to survive snack crumbs and enthusiastic shuffles. Involving kids in maintenance teaches stewardship, repair, and care for shared household tools and experiences.

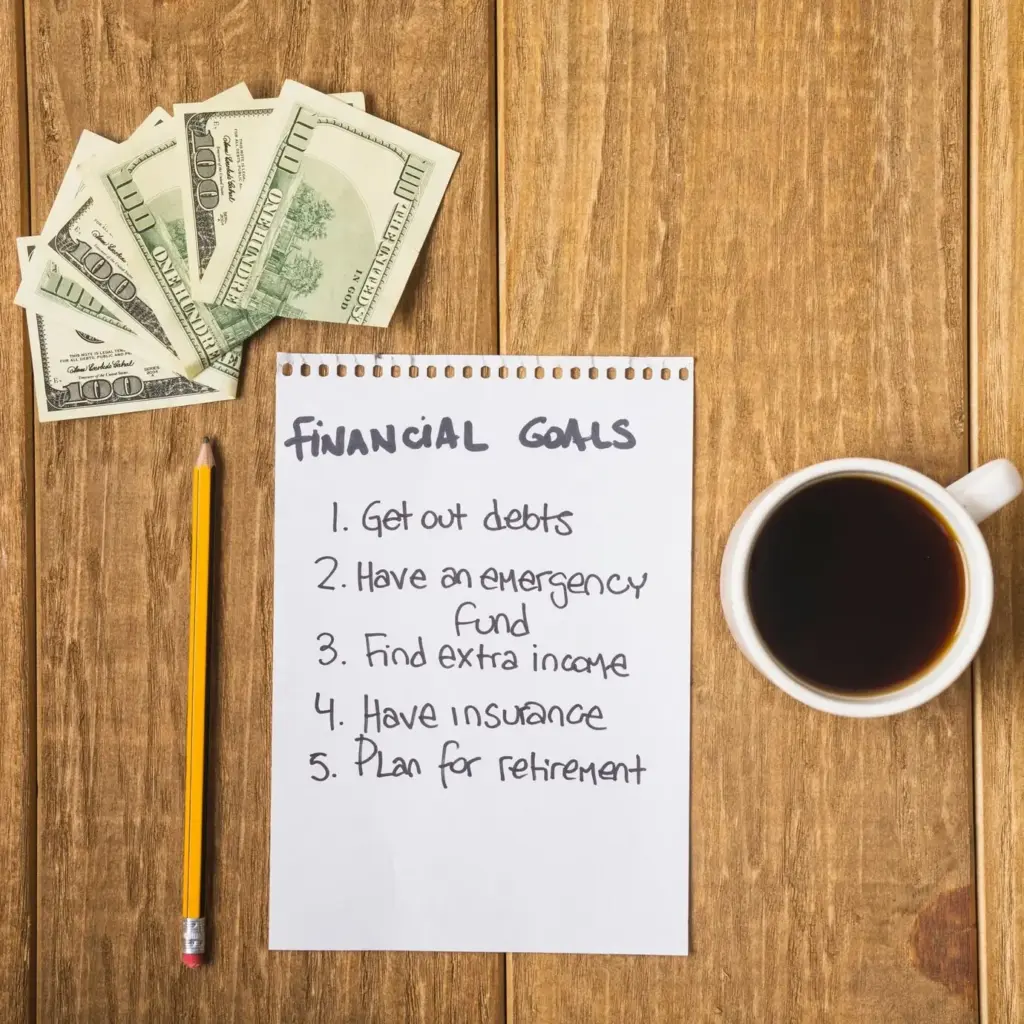

Game Mechanics that Grow Money Muscles

Income, Expenses, and Slack

Give players fixed starting income, then introduce fluctuating side gigs and surprise bills. Require an end-of-round budget check where unused cash can become savings or debt reduction. The visible buffer—your slack—teaches why small cushions protect plans when life's little storms inevitably arrive.

Opportunity Cost on the Table

Offer tempting upgrades that force a choice: faster movement, extra roll, or an insurance card. Buying one means postponing another goal. Encourage players to explain choices aloud. Hearing reasoning builds empathy, strategic thinking, and a habit of articulating money decisions before committing funds.

Risk, Insurance, and Resilience

Chance cards introduce job loss, bike repairs, or a neighbor needing help. Players decide whether past insurance purchases cover the hit. This mechanic models resilience, transforming scary surprises into planned bumps, and invites nuanced conversations about generosity, community, and responsible safety nets.

Narratives Kids Remember: Characters, Quests, and Consequences

Stories turn rules into journeys. Give each player a persona—student, caregiver, gig worker—with unique starting conditions. Quests like saving for a bike or supporting a fundraiser add purpose. Consequences after choices create continuity, making budgeting feel like an unfolding adventure rather than a worksheet.

Prototyping Like a Pro: Printables, Pieces, and Quick Iterations

Printable Card Templates

Create a simple grid in a word processor and duplicate it for expense, income, and event decks. Leave blank lines for house rules discovered during testing. Sharing editable files with friends invites collaboration, feedback, and a growing library of community-made improvements and surprises.

Token Hacks from Everyday Objects

Use paperclips as savings trackers, dried beans as coins, and washi tape to mark milestones on the board. Swapping in themed pieces for holidays keeps interest high. Resourceful substitutions model frugality and celebrate creativity over consumption, reinforcing the message your game already teaches.

Feedback Loops That Stick

End sessions by asking two questions: what was fun, and what felt confusing or unfair. Translate answers into a single rule change next time. Tiny, consistent improvements keep everyone invested and make learning feel like a collaborative, family-led adventure worth repeating.

Testing Nights: Balance, Pacing, and Fair Fun

Turn testing into a cozy ritual with snacks, timers, and rotating facilitators. Track round length, cash flow, and win conditions. Adjust difficulty so younger players contribute meaningfully while older players stay challenged. Fair fun builds confidence and keeps the learning momentum strong week after week.

Beyond the Table: Turning Play into Real-Life Habits

Connect game actions to daily practices like allowance jars, grocery planning, and charitable giving. Use similar icons and language to bridge contexts. When a decision appears in real life, recall an in-game moment. The shared reference builds confidence, consistency, and a warm, values-driven money culture.

Inclusive Play: Multi-Age, Neurodiverse, and Culturally Aware Design

Welcome every learner by offering multiple ways to participate: visual cues, verbal prompts, and tactile aids. Provide quiet roles like banker or scribe alongside energetic ones. Include culturally diverse names, holidays, and spending norms. Inclusive design enriches conversation and ensures everyone’s experience meaningfully shapes the game.

All Rights Reserved.